- Published on

Is Amazon Stock Still a Buy After 6% Price Jump

- Authors

- Name

- Solo FIRE

Amazon AMZN beats analyst expectations on both revenue and EPS in Q3, here are some highlights:

- Revenue is up 11% YoY to $158.9 billion. This is impressive growth on top of an already enormous revenue base.

- The company is more profitable compared to a year before, with operating margin increased from 7.8% to 11%, which is really good to see.

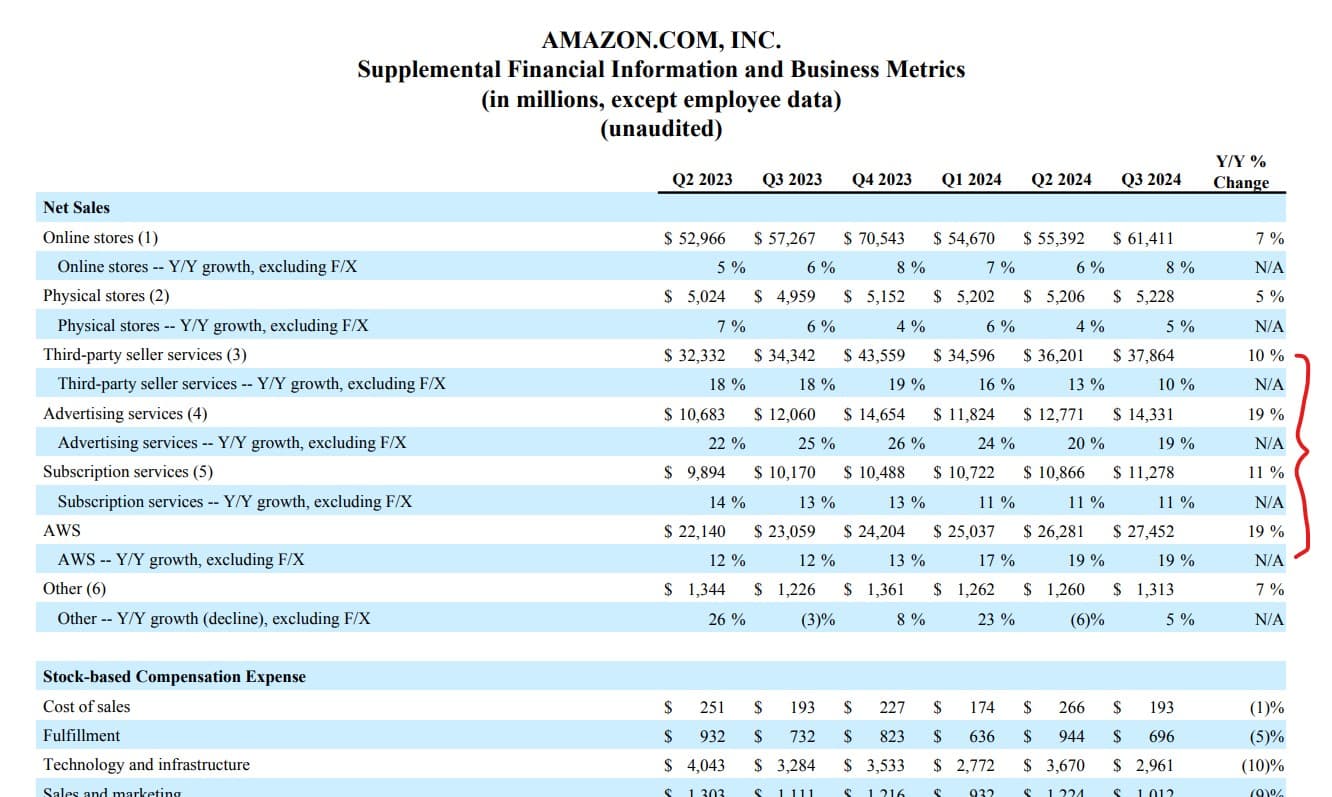

- All high margin business segments had double digits growth. The 3rd party seller business, Advertising, subscription and AWS revenues are up 10%, 19%, 11% and 19% respectively, as shown below.

- Stock-based compensation continued to decrease, down 9% from the previous quarter. The management has done a great job getting this under control.

- TTM Free cash flow has decreased 9.8% to $47.7 billion from previous quarter, this is due to a significant increase in capex, which is up 28% from $17.62 billion to $22.62 billion in a single quarter. In the earnings call, CFO has mentioned that the majority of the spend is to support the growing need for technology infrastructure. This primarily relates to AWS as the company invests to support demand for the AI services.

Looks like Amazon has really doubled down on developing its AI capacity to compete with other cloud provider such as Google and Microsoft, which I think is necessary to keep the company ahead of the competition. Given Amazon’s track record, this investments should yield great returns. The ROIC of the quarter is 18%, indicating a strong return on invested capital.

The estimated fair price of Amazon stock is about $251.82 per share using the DCF model, indicating a 15% CAGR in the next 5 years. Due to significant capex which significantly reduced free cash flow, I projected the valuation using operating cash flow instead:

- Latest TTM Operating cash flow (OCF) $112.7 Billion

- OCF annual growth rate of 15% (5YR AVG 26.11%)

- Share dilution of 1.27% per year (5YR AVG 1.27%)

- Future Price/OCF ratio of 20 (5YR AVG 25)

- Discount rate of 10%

I think Amazon stock still looks undervalued after the price surge. I personally plan to continue buying more into this company going forward.

If you are interested in how I run the DCF calculation to find the fair value of any stock, make sure to checkout this Youtube video I created to show you exactly how to do it with an example.

You can also see all my past Amazon stock analysis using this link.

Holdings Disclosure

- SoloFIRE AMZN ownership: 7% of portfolio

- SoloFIRE AMZN Average Cost Paid: $112.48

- AMZN price as of writing: $197.93

- Holding time: 3 years

For on-going changes of my holdings with in-depth analysis, make sure to check out my porfolio updates.

To keep track of my full stock portfolio, please follow me on Blossom Social

Comments and Questions

Make sure to leave your comments and questions on my original Blossom post

DISCLAIMER: Solofire is not a registered financial advisor. This post contains author's personal opinion only and it should NOT be considered financial advice.