- Published on

Google Beats Earnings, the Stock Went Down Anyway

- Authors

- Name

- Solo FIRE

Google GOOGL reported record revenue of $84.7 billion and EPS of $1.89, a 14% and 31% growth respectively. DCF calculated fair value is about $178.72, here are the assumptions:

- Latest TTM Free cash flow (FCF) of $60.8 billion

- Free cash flow growth rate of 15% (5 YR avg is 21.73%)

- Future Price/FCF of 25 (5 YR avg is 26.18)

- Share repurchase of 2.2% of understanding shares annually (5 YR avg is 2.2%)

- Discount rate of 10%

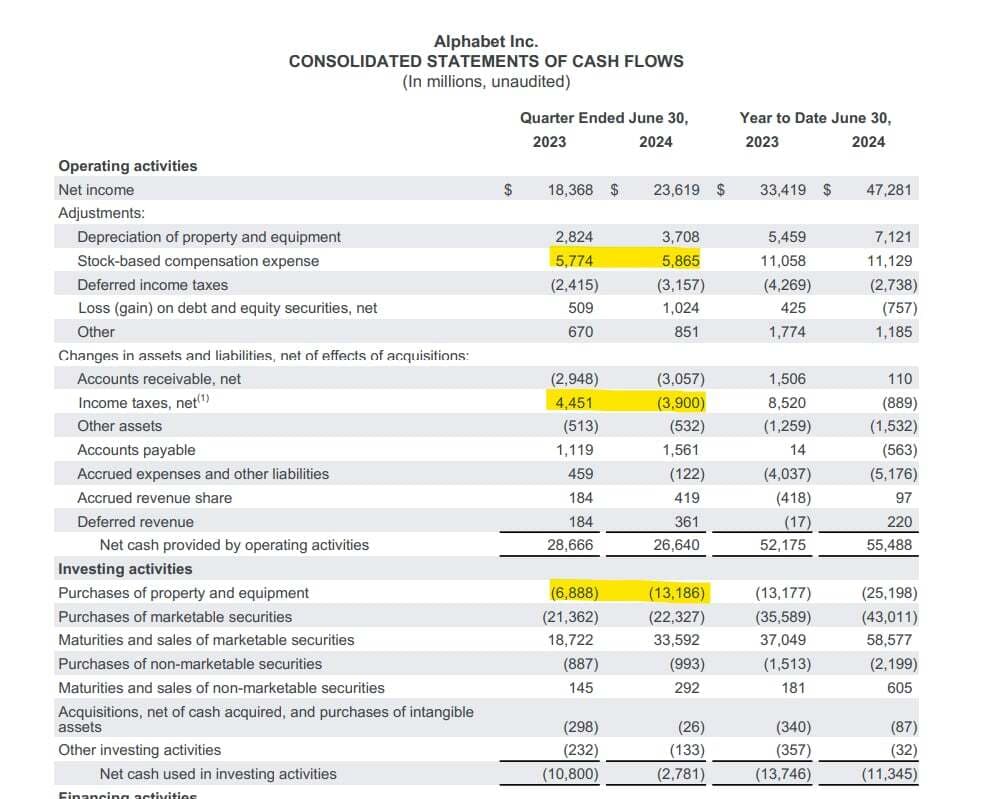

This valuation should be on the lower end due to less free cash flow generated. Google reported a free cash flow of only $13.4 billion for the quarter, a decline of 20% due to increased infrastructure spending (For Google cloud and AI) and some tax accounting gymnastics, as shown in the screenshot below. Given the company’s high historical ROIC, averaging around 18.7% for the past 10 years, these tech infra investments should yield great long term returns. We can already see the proof this quarter from the exceptional growth of the Google cloud.

Another good sign is that the stock-based compensation didn't grow much this quarter.

Overall, I think this is a good quarter for Google and the stock should be slightly undervalued.

Click here original post and comments on Blossom

DISCLAIMER: Solofire is not a registered financial advisor. This post contains author's personal opinion only and it should NOT be considered financial advice.