- Published on

Salesforce Stock is Down, Missed Q4 Revenue

- Authors

- Name

- Solo FIRE

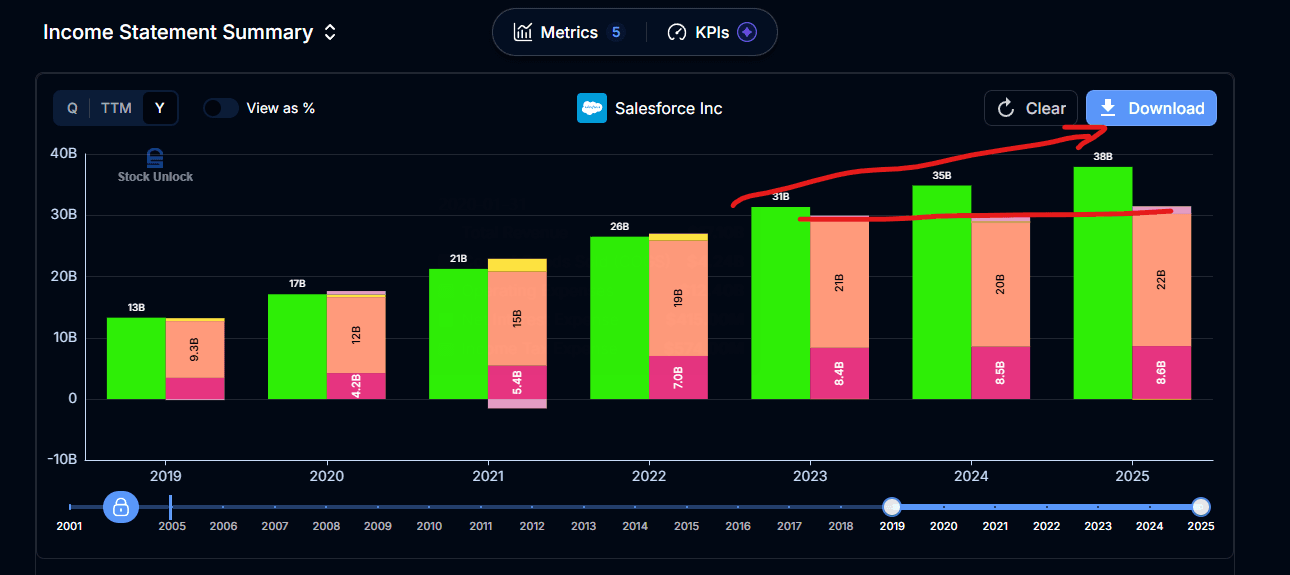

Salesforce CRM stock has traded down 3% since it reported earnings last Wednesday, likely due to the revenue miss and weaker than expected FY2026 revenue guidance. Personally, I’m satisfied with this report as the profit margins continue to grow along side the revenue. The management has done a great job keeping the expenses under control, as shown in the diagram below (green bars represents revenue, the other represents expenses).

Here are some highlights of this report:

Full year revenue of $37.9 billion, up 9% both Y/Y

Free cash flow of $12.4 billion, up 31% YoY

Bought back $7.8 billion worth of shares, that’s 2.7% of total shares

Operating margin of 33.0%, more profitable than last year’s 30.5%. The management is forecasting further margin expansion to 34% in the upcoming year.

Stock-based compensation (dilution) increased 14% from $2.787 billion to $3.183 billion. Not ideal, but it has slowed down compared to previous years, and slower than FCF growth rate.

$900 million Data Cloud & AI annual recurring revenue, up 120% YoY. It’s Agentforce product (AI customer assistant chatbot) has automated 380,000 conversations, achieved an impressive 84% resolution rate, with only 2% of the requests requiring human escalation. This product should help clients save even more on customer support, resulting in deeper integration with client applications, and further increasing the switching cost which should help protect Salesforce’s competitive advantage.

The estimated fair value of the stock is $329.8, indicating a CAGR of 12.26% in the next 5 years. Here are the assumptions for the DCF model:

- Latest TTM FCF $12.434 billion

- FCF growth rate of 10% (5YR avg of 28%)

- 0% Share dilution (5YR AVG 1.84%, but -0.37% in recent 3 years)

- Future P/FCF of 25 (5YR avg 35)

- Discount rate of 10%

I believe the company is reasonably valued and I plan to continue holding the stock for the long-term.

You can also see all my past CRM stock analysis using this link.

Holdings Disclosure

- SoloFIRE CRM ownership: 2% of portfolio

- SoloFIRE CRM Average Cost Paid: $260

- Holding time: less than 1 year

For on-going changes of my holdings with in-depth analysis, make sure to check out my porfolio updates.

To keep track of my full stock portfolio and get live trade updates, please follow me on Blossom Social

Comments and Questions

Make sure to leave your comments and questions on my original Blossom post

DISCLAIMER: Solofire is not a registered financial advisor. This post contains author's personal opinion only and it should NOT be considered financial advice.