- Published on

My Smith Maneuver Setup with National Bank in Details

- Authors

- Name

- Solo FIRE

Smith maneuver is a strategy of converting Canadian non-tax-deductible mortgage into tax deductible HELOC for investment purpose only. The goal is to paydown the non-deductible mortgage as soon as possible using investment income and tax rebate.

The catch here is that 0 additional cash flow is needed, you will still pay the same amount of mortgage each month. Because each mortgage payment will have a portion going into mortgage principal, this portion will be added onto your HELOC credit limit. We can then use this additional credit to pay the interest of the HELOC. This is called interest capitalization.

Note that this strategy will cause your HELOC balance continues to increase, and it will only work well if you are confident in your investing skills, which must yield higher returns than the interest paid on the HELOC. This is also a good strategy if you are in a high tax bracket.

If this is confusing, don’t worry and it will become more clear (hopefully) after you see my personal example below.

My setup as of 2024 Sept. 13

- I’m using National bank for my setup. Their professional package offers low HELOC rate.

- $600k condo value, remaining mortgage balance $415,975, 5.55% variable rate mortgage

- Just got approved for $60k HELOC, interest rate 6.7% (prime + 0.25%). My marginal tax rate is 43%, so effective interest rate is 6.7%*(1-43%) = 3.8%. It is very easy to get a investment return higher than 3.8%.

- Expected investment return 10%. My past performance has been ~19%, but I think I got lucky with picking the right stock during bear markets. A 10% return should be more achievable by just holding prominent, boring dividend growth stocks like CNR, IFC.

Lessons learned so far

- National bank HELOC charges $7 per month, no waiver possible. This sucks but is an acceptable cost. I will look at other banks when my mortgage renews in 2 years.

- If you have more than $250k with NBDB, HELOC rate will be reduced to prime + 0

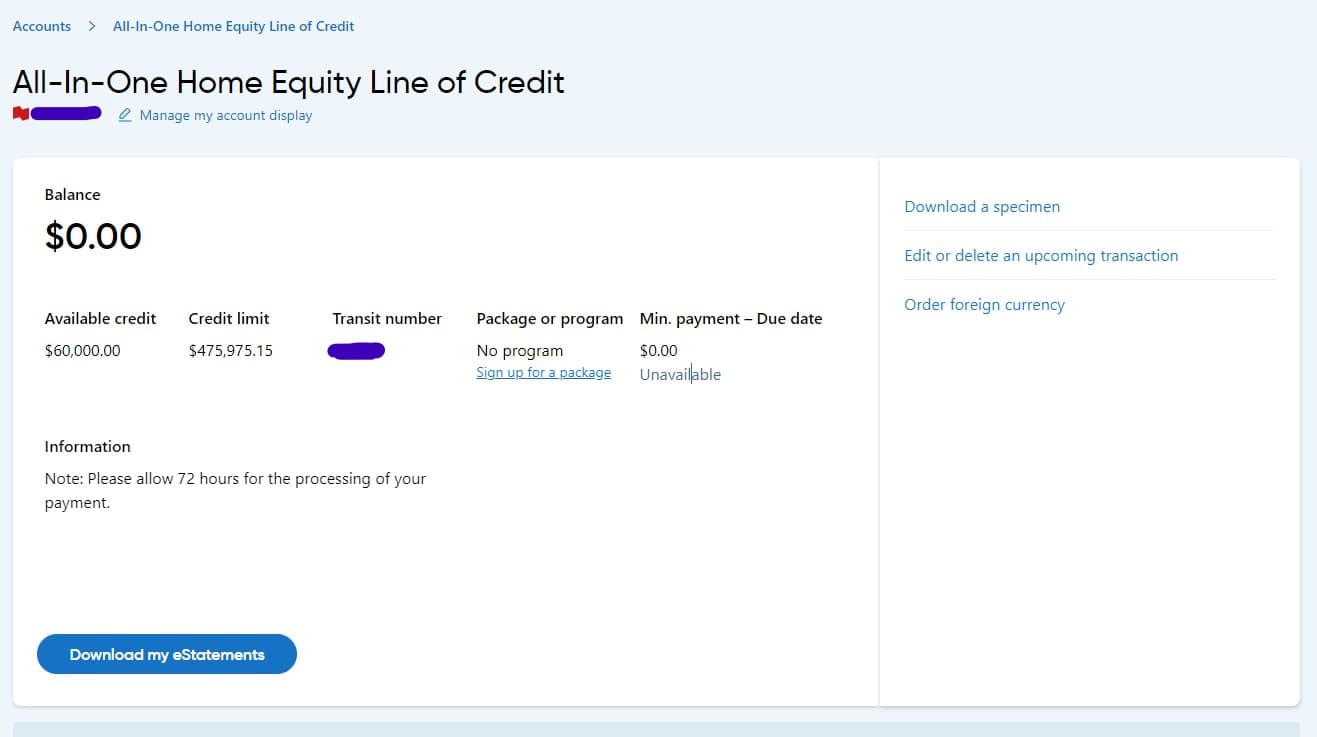

- The new 65% LTV requirement is for standalone HELOC only. In my case, I was able to refinance my conventional mortgage to an all-in-one mortgage, to 80% of my condo value. The new mortgage allowance is $475,975. Since I’ve already paid down $60k of it, I got those as my HELOC credit and there is no change to my original mortgage balance and monthly payment. All in all, the setup cost nothing except the $7 monthly fee.

See the screenshot below for my detailed setup. My old setup was simply using my monthly cashflow to pay down the mortgage and any excess (after maxing out the registered accounts of course) will be invested in a non-registered account. With the new Smith maneuver setup, the excess cashflow will be used for paying down the non-deductible mortgage. This additional payment will increase my HELOC limit, allowing me to invest the same amount, but the interests paid overall will be less.

For now, I will consider the plan successful as long as the investment portfolio grows faster than the HELOC balance. I will continue to post updates about my progress, so make sure to follow me on Blossom.

As usual, I will create a collection for all my Smith Maneuver updates on my website: https://www.solofire.ca/tags/smith-maneuvre

For a more detailed explanation of Smith maneuver, check out this this blog post that contains a step-by-step guide

Here is a great website to learn about your tax bracket

Comments and Questions

Make sure to leave your comments/questions on my Blossom post and I will try my best to answer them.

DISCLAIMER: Solofire is not a registered financial advisor. This post contains author's personal opinion only and it should NOT be considered financial advice.