- Published on

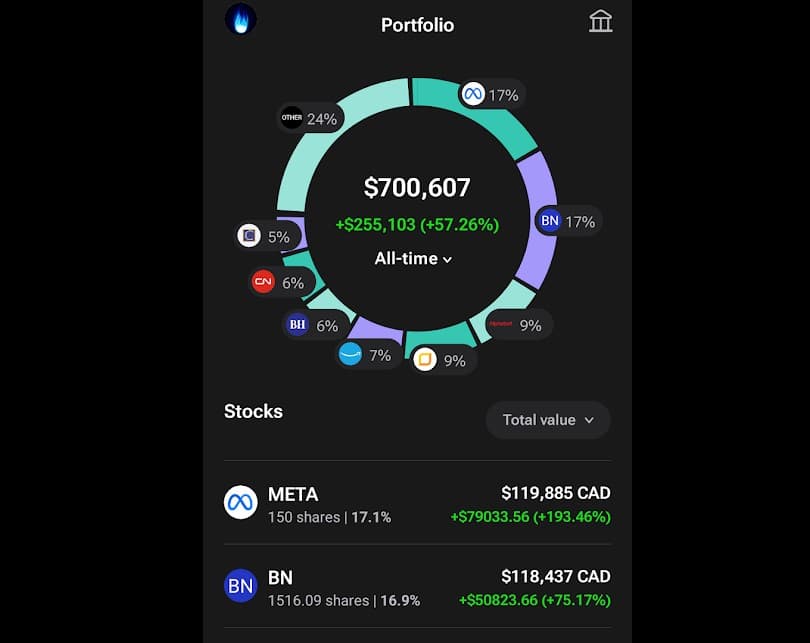

Stock Portfolio Surpassed $700k

- Authors

- Name

- Solo FIRE

I am feeling excited to achieve this milestone and I am closer than ever to my FIRE number. When I started with $6000 at the end of 2018, I would never have expected to reach this number in 6 years. Looking back here is what I think I did right:

Things I did Right

- Negotiated higher salary every year. This is especially helpful when I first started working full time in 2019 and with a low start salary, allowing me to save more and more while I kept my expenses low

- Read my first investing book, The Intelligent Investor, before I started investing. This helped me establish strong belief in long-term investing principals and avoided all the short term speculation based methods promoted on the internet.

- Ignored "experts" and invested in stocks using my own valuation method ONLY. Nobody knows the future, and the only thing I can trust is the company performance and its management team.

- Invested in undervalued stocks when the market is down. Here are a few examples: Invested in AXP/BRK-B in 2020, META/GOOGL/AMZN/ADBE/EQB in 2022, BN in 2023. I usually start buying as soon as the price drops below my buy price, and buy in gradually without trying to time the bottom.

- I changed my philosophy to invest in high quality companies at fair prices, instead of investing in lower quality but cheap companies. My performance has improved since I pivoted in 2022.

- Sold losers despite huge losses. This is one of the most important, for example I sold my entire INTC position (~10% of portfolio) with 50% loss in TFSA and bought META instead in 2022. This was the best decision I have ever made. What I learned is only the future matters, and hoping for a bad company to turn around will likely cause further losses.

- Subscribed to some of the best stock Youtubers like Joseph Carlson, Daniel Pronk and New Money

Some bad decisions and hard lessons

- Invested in a Russian stock (Gazprom) just because it looks cheap, and it was cheap for a reason. I lost 70% of my investment in 2022 when it was delisted due to the war. Geopolitical risk should never be underestimated.

- Invested in BABA at $230 because I thought it was cheap, until it dropped another 25% and Jack Ma disappeared. Good thing that I was cautious and didn't put too much into this position. I have since then swore to never invest outside of developed countries. The political and regulatory risk is real in China.

- Shorted Shopify in 2020 at $1000 and panic bought back in 2021 at $2000 (pre split) just before the price crashed, locking in 50% loss plus 10% interest paid. Now I fully understand "Shorting stock is hard business" - Warren Buffett

- Pinch the pennies. I remember trying to buy EQB just a few cents lower by setting a limit price when the stock was traded in $40s, and that order was never filled. I had to pay a much higher price later. Now I mostly use market orders to buy stocks.

Hope this helps. I will regularly post about market updates, quarterly stock analysis and FIRE updates on Blossom, so make sure to follow me there. Also feel free to check out my youtube channel if you are interested in more FIRE tips and how I analyze stocks: https://www.youtube.com/@solofireca

Comments and Questions

Make sure to leave your comments and questions on my original Blossom post and I will try my best to answer them.

DISCLAIMER: SoloFIRE is not a registered financial advisor. This post contains author's personal opinion only and it should NOT be considered financial advice.