- Published on

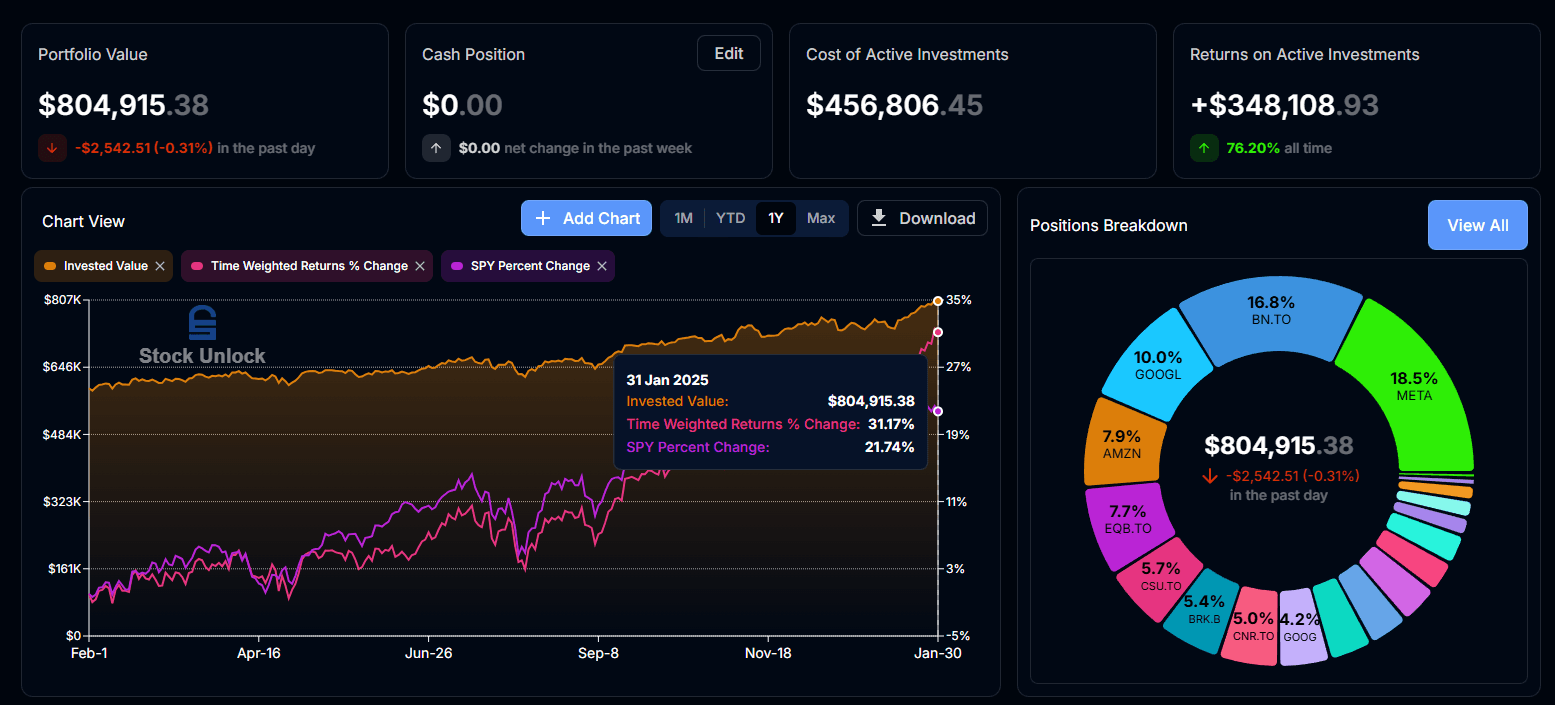

Portfolio Crossed $800k

- Authors

- Name

- Solo FIRE

This blew my mind considering my portfolio value only went above $700k 3 months ago. This value increase includes $19k of new contribution: $7000 of TFSA contribution, $2000 of non-registered contribution, and $10k of emergency fund moved from savings into CASH and HSUV-U ETFs.

Looking back, my portfolio only exploded in value in 2023 and 2024, and the most important thing I did is to build up a position when the stock is out of favour, and the process is difficult. I remember doubting myself everyday about the decision I made, and the lure to just sell and end the struggle is real.

For example, BN is one of my largest holdings today, and many people only heard about the stock after it had gone up in 2024. I first started investing in BN in 2020 and continued to build the position from 2021 ~ 2023 while the stock went through a slow and painful bear market, losing 30% of its value in 2 years. The following are the things I looked for that allowed me to continue holding on to the stock:

The company grew its earnings despite facing headwinds of high interest rates. BN is one of the 2 largest alternative fund managers on the market, I think being the strongest player in the industry really helps defend the profitability of the business. I was in doubt at first, but quarter after quarter, BN was able to consistently grow its assets under management, and the earnings followed.

The company leaders continue to hold a significant amount of BN shares, and keep buying more when the stock price goes down. These insider purchases gave me a lot of confidence in the stock. I personally compare the amount of insider ownership to the salary of the insider. Brookfield CEO owns $4 billion worth of BN shares while his total compensation is $6 million, a lower than average CEO salary. The stock owned way higher than his salary, which means the CEO is highly incentivized to increase shareholder values.

In contrast, INTC CEO also continues to purchase Intel stock, but the amount is usually in the 100k~200k range, much lower than his 10 million+ salary. The same goes for his stock ownership. This could suggest that Intel CEO is not fully committed to improve shareholders value because he won't lose much if the company underperforms.

- BN has developed new products to combat the high interest rate environment. This company has not been sitting still and blame the market for its downturn. It has successfully built up an insurance business within just a few years, which benefited from the high interest rate environment, effectively hedging the headwinds from its real estate business.

In conclusion, I think the most important thing needed to profit from the stock market is the ability to understand your companies well enough to be able to continue building up the position while the stock is going down. I hope this post can help you achieve more success in your investing journey.

Comments and Questions

Make sure to leave your comments and questions on my original Blossom post and I will try my best to answer them.

DISCLAIMER: SoloFIRE is not a registered financial advisor. This post contains author's personal opinion only and it should NOT be considered financial advice.